Grow Your Business. Support Your Clients. Earn More.

Join the My Personal Broker referral network and unlock a simple, transparent way to offer your clients access to fast, flexible personal loans — while earning commissions on every approved loan.

Whether you’re a mortgage broker, finance specialist, accountant, or adviser, partnering with us is an easy way to expand your service offering and grow your business.

How It Works

Our broker program is designed to be simple, fair, and rewarding.

- Apply to Join – Complete our quick registration form.

- Get Approved – Once approved, you’ll receive access to your broker portal.

- Share Your Personal Link – Use your custom referral link to invite clients.

- Clients Apply Online – Your clients complete their own applications directly through your link.

- Earn Commission – When a client’s loan is approved and settled, you receive your commission.

Everything is tracked automatically through your broker dashboard — no manual forms, no chasing updates.

Why Partner with My Personal Broker

We’re not just another loan platform — we’re your partner in helping Australians access fair, fast, and flexible finance.

Ideal for Mortgage Brokers and Finance Specialists

If you’re a mortgage broker, financial adviser, planner, or accountant, partnering with My Personal Broker lets you expand your offering and help clients access personal loans — all without the extra admin or licensing burden.

Your clients already trust you for expert financial advice. Now you can support them with the full range of personal finance options — from car and travel loans to debt consolidation and home improvement finance.

What’s in it for you

Expand your services and add new revenue streams

- Enhance client relationships by offering a complete finance solution

- Earn competitive commissions on approved personal loans

- Simple referral system — clients apply through your personal link, and we handle the rest

- Transparent process — all applications and commissions tracked in your portal

Whether your clients are renovating, refinancing, or simply managing day-to-day expenses, you’ll have an easy, trusted way to assist — and get rewarded for it.

How Mortgage Brokers and Finance Specialists Use Our Platform

Our partners use My Personal Broker to complement their existing services and stay connected with clients long after a transaction.

You can:

Include your personal referral link in post-settlement follow-ups or newsletters

Share it directly with clients seeking finance for cars, renovations, or debt consolidation

Track every referral and commission through your secure broker portal

No complex integrations, no chasing paperwork — just a smart, simple way to add value and grow your business.

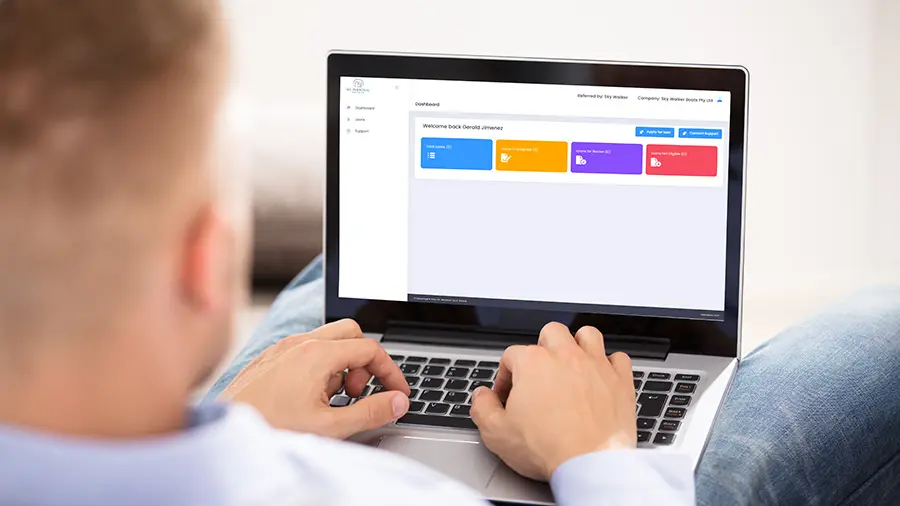

Your Broker Portal

Once approved, you’ll get instant access to your secure broker dashboard, where you can:

Generate your unique referral link

Track applications and approvals in real time

View and manage commissions

Access marketing resources and support

It’s designed to be simple, efficient, and mobile-friendly — so you can manage everything on the go.

Commission Structure

We believe in transparency and fairness.

Your commission is paid for every approved loan that originated from your referral link — automatically and on time.

You’ll enjoy:

Straightforward commission rates (no hidden deductions)

Prompt payment after loan settlement

Ongoing earning potential with every referred client

We’ll provide full details of the commission structure once your application is approved.

Frequently Asked Questions

How long does broker approval take?

In most cases, approval is completed within 1–2 business days.

Is there a cost to join the program?

No. Joining the My Personal Broker Partner Program is completely free.

How are commissions paid?

Commissions are paid directly to your nominated account once the loan has been settled.

Can I refer multiple clients at once?

Yes — you can share your link freely with as many clients as you like. Each referral is automatically tracked in your portal.

What types of loans can my clients apply for?

Your clients can apply for personal loans across various categories — including car, travel, medical, home improvement, and debt consolidation.

Case Study: Building Client Trust Through Partnership

Mark, a mortgage broker based in Sydney, wanted to help his clients access personal loans without having to manage the lending process himself.

He joined the My Personal Broker Partner Program to offer a simple, trusted way for clients to apply for finance — while earning commission on every successful loan.

Using his personal referral link, Mark integrated the service into his existing client process. When a client needed a loan, he simply shared his link, and they completed the application themselves online.

Within a few months:

Mark had referred over a dozen clients, most of whom were approved.

He earned regular commissions with zero administrative burden.

His clients appreciated the fast approvals and clear communication.

“The portal made it so easy — I can help my clients get what they need, without any paperwork or follow-up. My Personal Broker takes care of everything, and I still get rewarded for helping.”

— Mark, NSW

Mark’s story shows how partnering with My Personal Broker is more than just an extra income stream — it’s a way to strengthen relationships, add value, and grow your business with confidence.